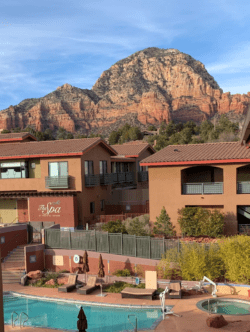

What do you see when you look at this picture? Now show it to your spouse and ask what they see. You might find that two people can look at the same picture but have two different visions. I personally experienced this recently on a trip with Kimberly.

The picture is of a place we stayed in Sedona, Arizona after hiking the Grand Canyon together. Kimberly saw “The Spa,” and envisioned what that experience would be like. The vision was one of relaxation, massages, calmness, re-energizing, soft music, and warm towels. I, on the other hand, saw the mountain. I immediately had visions of climbing to the top. Legs burning, sweat pouring, the Rocky theme song blaring in my earbuds. You get the picture.

When we do financial planning for couples, this is precisely why we insist both spouses be engaged in the process. A term as vague as “retirement” can result in a broad spectrum of visions. Couples can both identify retirement as a financial goal and envision what that looks like for them as individuals. However, it is quite possible that there are two entirely different visions of what retirement looks like.

You may see a vision of traveling the world while your spouse sees settling down and downsizing. One spouse may want to begin a gifting strategy to children and charitable organizations, while the other has visions of spending lots more money on going and doing. You can easily see how different the to-do list would be based on the goals, which are first and foremost determined by the vision.

This is why our process begins with a conversation. Every prospective client engagement begins by you coming into our office and discussing your vision in our conversation room. It is the most important part of the process. Each client’s unique vision is the basis on everything else we do. The financial plan, the goals, the appropriate investment portfolio- all based on the client’s vision of what it means to “Live Your Life.”

We are calling this month’s theme MARCH MADNESS because without a well thought out financial plan, connecting your individual visions to a combined vision can seem like complete madness. It’s confusing and unclear, and often ends with “we’ll get there when we get there.” This month, we’ll look at different components of retirement planning, all within the context of your vision.

So, what’s your vision? What’s your spouse’s? Have they been communicated? We want to help facilitate these conversations, so schedule a visit with us today and let us help you begin pursuing your vision.